In this OANDA review, we will look at the multi-asset broker’s features and costs, demo account, and customer support. The forex section is separate from the trading platform and opens in a separate tab. Trading with this broker requires a minimum investment of $500k and knowledge of financial derivatives. OANDA charges spreads for different assets and overnight fees for leveraged positions. Nonetheless, the low trading costs and 24/7 customer support make this a great multi-asset broker.

OANDA is a multi-asset broker

OANDA is a leading provider of online multi-asset trading services. They recently announced their acquisition of Dom Maklerski TMS Brokers SA, the oldest multi-asset broker in Poland. The firm offers its clients a wide range of financial products and offers a suite of innovative trading tools and educational resources. To learn more about OANDA, read on. This article will introduce some of the company’s main features.

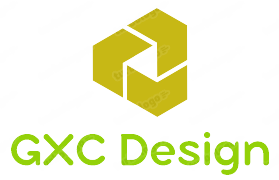

OANDA’s trading platform offers 68 currency pairs, fifteen index CFDs, twenty metals, five commodity and cryptocurrency CFDs, and 5 CFD bonds. It has regulatory oversight through multiple agencies, but doesn’t provide any additional deposit protections. The company has a good knowledge base and a searchable archive that should answer most questions about trading platforms. However, for people who are still new to the world of trading, OANDA’s limited product offerings may not be enough.

It offers low trading costs

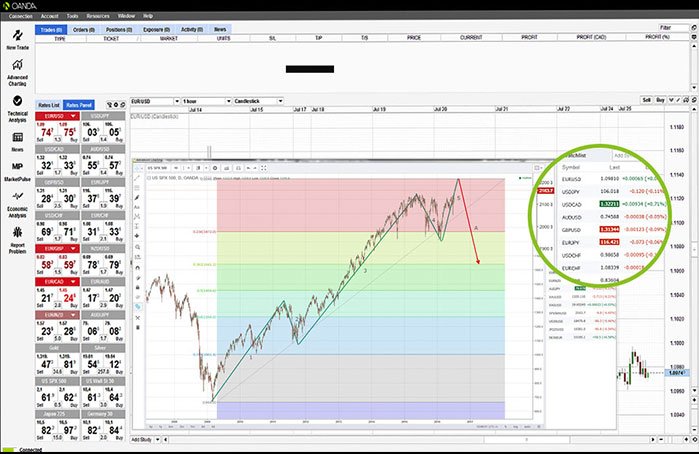

OANDA is a broker with no account minimum. In addition to their fixed core pricing, OANDA charges a low spread rate of 0.4 pips on EUR/USD. They source pricing from their global network of premier banks, and do not re-quote at the time of trade. In addition to their low spread rates, OANDA charges no account opening fees or monthly inactivity fees. You may also encounter a small fee when you withdraw funds, but these are minimal.

Trading costs vary by instrument and size. A typical trade involves buying an instrument and holding it overnight. Other costs include commissions, spreads, and financing costs. If you trade on margin, you can incur heavy losses. To keep your trading costs down, you can use margin trading on OANDA. The spread is calculated based on market liquidity and volatility. The margin requirements vary by product and geographic region, but are typically lower than those of agency brokers.

It offers a demo account

OANDA Broker Review has an extensive range of trading products. You can choose from the Core Account or the Standard Account, and you can even sign up for an Islamic account if you’re a Muslim. The demo account is a good way to learn and experiment with trading strategies without taking any risks. It’s easy to open, and there’s no expiry date, and you can use it to practice before you decide to invest your own money.

The demo account is the easiest way for beginners to learn and practice trading before moving on to live accounts. The demo account also allows you to refine your strategies and trade using virtual funds. There’s no minimum initial deposit required, and it’s free to sign up for a live account. If you’re new to the forex market, Oanda’s demo account will give you a feel for what trading will be like. In addition, it lets you test out its services before making a full-sized deposit.

It offers 24/7 customer support

OANDA offers a live chat support service through its support page. You can chat with a live agent around the clock, and it works the same way as an email support system. You can choose whether to speak with a Virtual Assistant or a live agent. The latter offers a quick and easy solution for your questions. It’s also instantaneous and can suggest answers based on the information you typed.

For the Premium account solution, you can pay US$35 per million in trade volume. You will also receive spread or commission reductions, a dedicated relationship manager, and API support. If you invest over $10,000, you can also get benefits like free VPS, unlimited wire transfers, and priority service queues. OANDA offers several types of accounts, including the Advanced Trader Account, Standard account, and Premium account. For more advanced traders, the Premium solution offers a host of advantages.

It offers a mobile trading platform

Mobile trading is becoming increasingly popular, and OANDA offers one for the Android and iOS platforms. Unlike some brokers, OANDA and IG Forex Brokers do not charge a fee for depositing funds, although withdrawals can be difficult to process. The company also offers a free demo account for new customers, and offers several options for deposit and withdrawal, including digital wallets. The OANDA web trading platform also lets customers use their bank accounts to make deposits or withdrawals, as well as view their fees and processing times.

Users can use the OANDA app on the go, with features such as 1-click trading, alerts, and economic calendar. It also offers two-factor authentication for increased security. The app is available in English, Chinese, Japanese, and German. OANDA has an array of execution venues to meet the needs of its global client base, including a mobile-optimized trading platform. OANDA’s platform is designed for professional traders, but it’s also useful for beginning traders.